Five US Central Bank Digital Currency pilots to take flight

- B Vrettos and M Bacina

- May 7, 2021

- 2 min read

After the swell of support emerging from the U.S. for digital asset related projects, the US non profit Digital Dollar Project has announced the first major move for the US into CBDCs.

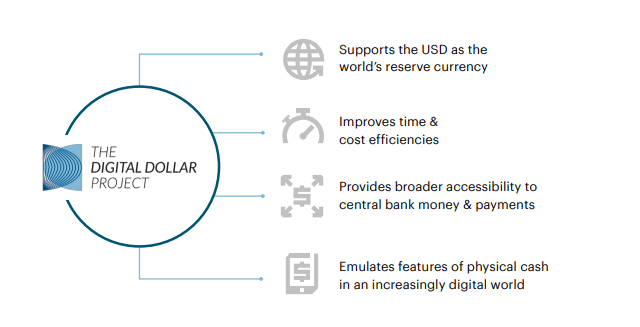

The Digital Dollar Project (DDP) is an initiative between Accenture and the Digital Dollar Foundation with a mission to:

launch at least five pilot programs over the next 12 months with interested stakeholders and DDP participants to measure the value of and inform the future design of a U.S. central bank digital currency (CBDC), or “digital dollar.

Former chair of the Commodity Future Trading Commission and co-founder of the Digital Dollar Foundation, Christopher Giancarlo stated that there was a gap of "real data and testing in the U.S." to inform the CBDC debate.

The DPP will complement the Federal Reserve's partnership with MIT for the 'Fedcoin' but the DPP has taken a divergent approach. While the DPP acknowledges the Fedcoin's ambitions to move more slowly and 'get it right' the first time, there are practical realities that other countries such as China are moving ahead in the CBDC space and in order to incorporate U.S. values such as "privacy, freedom of commerce and speech" into the development of CBDCs, the U.S. must take a more active role.

Three of the DPP's pilot programs are set to launch in the next two months and will generate data ranging from sociological aspects to business needs when assessing the desirable aspects of a CBDC. This data is reportedly due to be publicly released. Senior Managing Director at Accenture, David Treat, stated that CBDCs:

will play an important role in how we modernize our financial systems — increasing access to and inclusion within them while also providing a valuable innovation frontier for new products and services in conjunction with other key innovations such as digital identity.

With the DPP clearly noting the need for a timely U.S. response to engage in CBDCs it will be interesting to see if this impacts the initial hesitant timelines touted by the Federal Reserve. Australia meanwhile continues to consider CBDCs with innovative work being done by our Reserve Bank but no plans for a pilot of a retail CBDC at this time.

Comments